Amazon Search & Discovery

The Amazon Search & Discovery team consisted of a small group of cross-discipline UX and UI Designers, Researchers, Data Analysts, and Technical Product Managers. The team operated like an in house agency supporting all business pillars in regards to Search, Discovery, and Personalization solutions. If Prime Video needed browse solutions, Clothing Shoes and jewelry needed search results redesigned or Whole Foods Market was looking to optimize their information architecture our team would design and run the experiments and help launch successful solutions with the various business teams.

Big Bets for Search

There is strong evidence that several types customer behaviors exist when shopping on Amazon. The top five are Need Now or Buy Now, Fast Fashion and Traditional Mid-Market, High Quality and Brand Conscious, and Lack of Selection. Amazon wanted to improve how they dynamically optimized the customer experience to match the type of shopping journey the customer is on.

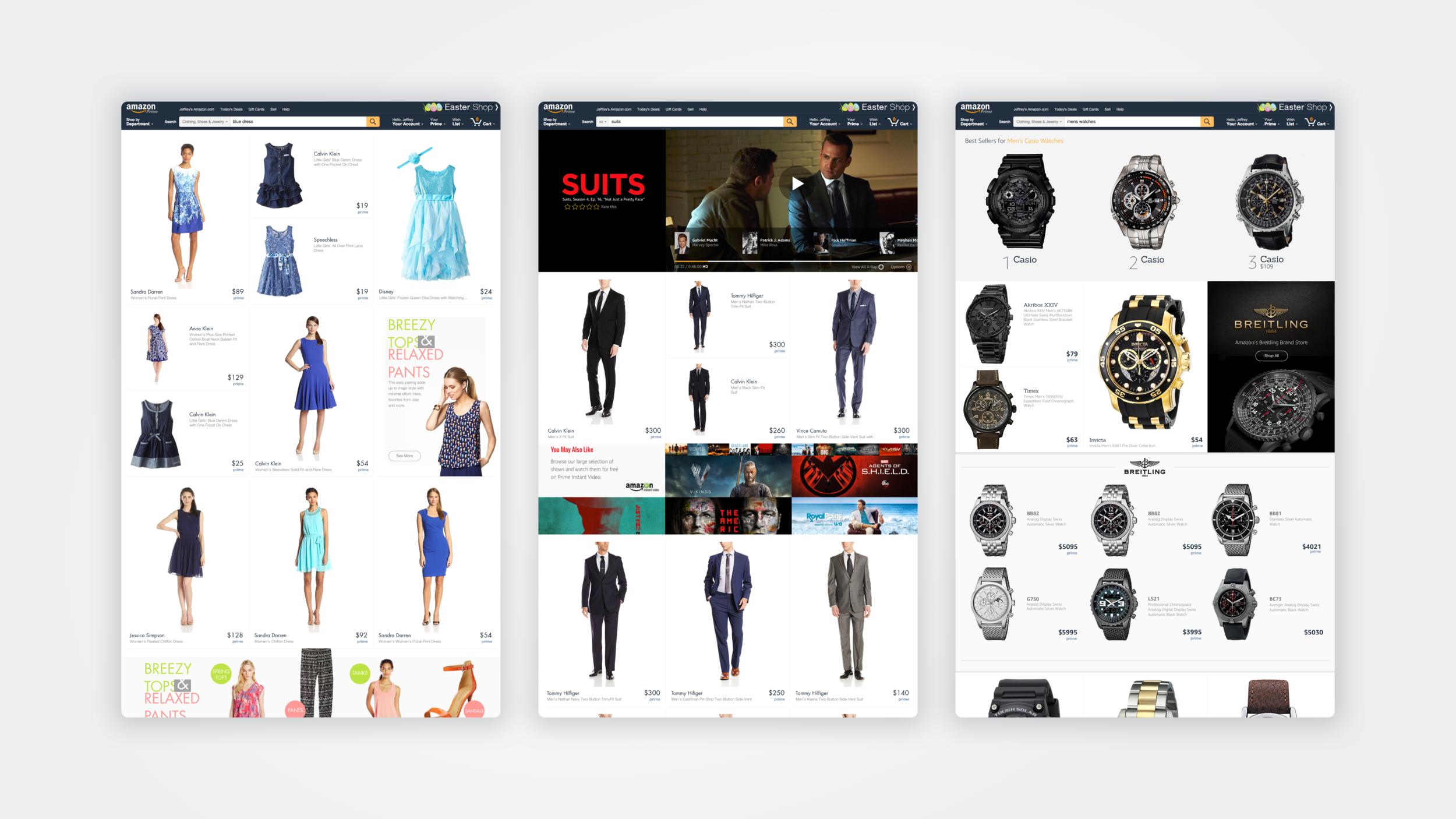

The Search and Discovery team recommend thinking about search experiences as a “Tapestry” that can be crafted to align with these customer behaviors. This includes rethinking the display of the grid of search results to bring customers more decision making information, progressive disclosure, federating results, and supplemental content.

The Search and Discovery team used large scale A/B testing as well as on-sight moderated eye tracking sessions to validate this set of recommended features.

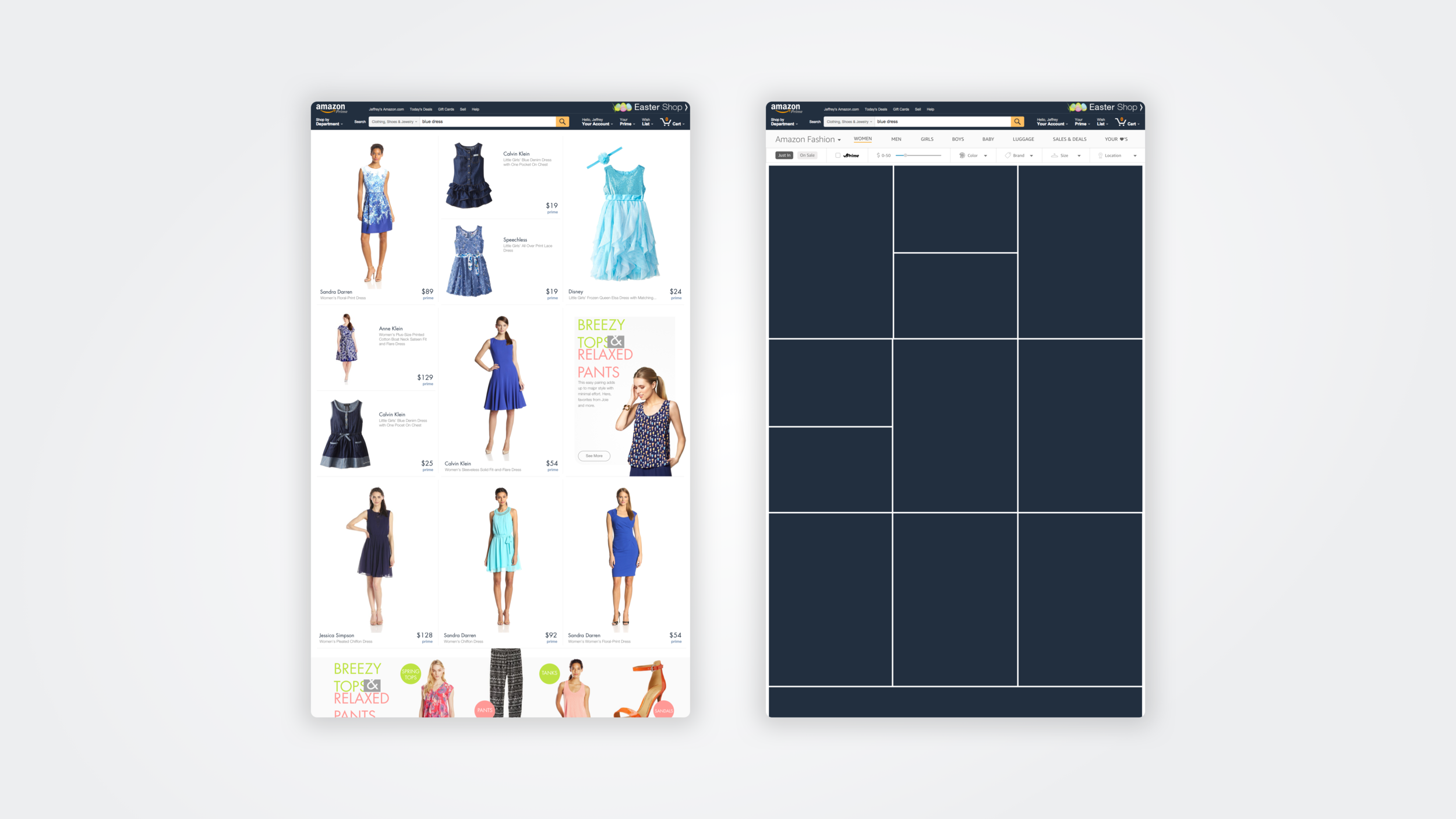

Tapestry Framework

The Tapestry framework gives us a simple, elegant, and scalable way to address the ambiguity and complexities of a modern search experience. Its 5x5 pixel grid provides a high level of flexibility that allows us to deliver appropriate experiences for the broad variety of products that we sell. As we continue to build on this framework, we will explore and become experts in the best way to sell entire categories of products. We will no longer sell “Dress Shirts” the same way we sell “Laptop Computers”. Instead we will uncover and implement the best possible way to sell each of these products through a scalable design language that is focused on delivering the best customer search experience at scale.

Progressive Disclosure

Not all information is relevant or even important at all stages of the shopping cycle. To reduce cognitive load on our customers and to provide the best possible customer search experience we will use progressive disclosure to share just the right information at the right time. For instance, in Softlines, research tells us that customers care most about Brand, Prime, and Price. To minimize cognitive load we can reduce ASIN data to these three critical elements. Then, we can use progressive disclosure to load the secondary potentially tertiary decision making data on hover.

As a part of this progressive disclosure strategy we redesigned individual search results (ASINs) with the goal to reduce cognitive load and improve scan-ability of the result set by only showing the most important data by default and only reveal additional details when customers engage further.

Leveraging the Framework

In the suits example we are using dynamic merchandising by surfacing results related to the show you are watching. We can use logic to configure the tapestry layout based on the hierarchy and density you need like in the men’s watches example

Federated Search Results A/B Test

As a part of the initiative to build customer trust that Amazon could be a destination for purchasing Fashion items we also tested integrating nationally recognized brand ingress points at the top of search results to drive more traffic to the nationally recognized brands.

Through this we can wow our customers with smart fresh experiences that drive growth in sales and engagement.

Supplemental Content

Supplemental Content is anything that isn’t natural search results. It must be contextually relevant; support, enhance or improve the search experience by giving customers answers to questions (Did you know) and help Amazon improve customer trust and the perceived authority of our search results.

One example is the In-line Brand Micro Store. This new supplemental content pattern will allow us to provide a highly curated and monetized experience for our brand partners.

Key aspects that we would propose validating with internal and external partners and testing with users are:

• In-line Brand Micro Store

• Shop through experience in the brand store Allow customers to shop through the In-line Brand Micro Store experience through add to cart without losing search context

APPENDIX A:

Softlines Keywords Clustering Analysis – Provided by Joe Bradley

Executive Summary

We performed a clustering analysis of head Apparel queries (~14% of all Softlines traffic, ~47% of Apparel traffic) based on customer behavior metrics. Through this analysis we found 5 distinct behavioral themes which will serve as a more granular dimension to evaluate Softlines search experiences. A post-hoc analysis of the fashion federation A/B test provided strong evidence of the efficacy of the themes. For additional validation we are re-testing our fashion federation experience with some keywords identified by the clustering removed from treatment. If the A/B test performs as expected we plan on using the clusters for additional experiments.

Description of Behavioral Clusters

Need Now, Buy Now.

This query cluster consists of queries with strong purchase intent. This is evidenced by high conversion (click, add, purchase) rates, low pagination, and low refinement usage. These queries also have an element of fragility as customers do not engage with search results via pagination or refinements. We hypothesize that any features to encourage browsing in this query category distract customers from purchasing.

Fast Fashion and Traditional Mid-Market.

These queries indicate browsing missions and a lower average selling price (ASP). These clusters are characterized by queries with lower query specificity, moderate conversion rates, and a high propensity to paginate and refine search results.

High quality, brand conscious.

These queries indicate interest in recognized, qualified, and likely high-end products. Metrics include high ASP, low to moderate conversion rates, and moderate specificity. Queries in this cluster predominantly include a brand name.

Lack of Selection.

Cursory evaluation indicates these queries include brands with inconsistent images and little to no (or 3P-only) selection. These queries have low conversion (click, add, purchase) and high abandonment.